Home Loans for Part-Time Workers: How to Get Approved

This article is by Loan Market Select. If you need home loan help, please just get in touch here.

Securing a home loan on part-time income might feel daunting, but it’s far from impossible.

In New South Wales and across Australia, lenders now recognise that stable earnings come in many forms, such as casual shifts, fixed-term contracts or gig work. Just show you’ve got consistent pay and sound money habits, and you’ll discover plenty of mortgage options, even without a 9-to-5 job.

In this guide, we’ll walk you through the steps to loan approval as a part-timer: from the types of home loans on offer to expert tips for strengthening your application.

Unlock Your Homeownership Potential:

Talk to our Sydney mortgage brokers today and let us tailor a home loan strategy around your part-time income. Call

0403 316 686 or visit

www.mortgagebrokersnorthernbeaches.com.au to get started!

Can you get a home loan with part-time or casual income?

Yes, you can get home loans for part-time workers, even on irregular hours. The key is showing lenders that your earnings are both consistent and sustainable.

Under Australia’s responsible lending rules, every lender must verify your ability to meet repayments without hardship. To do this, they typically require:

- Income history: At least 12 months of payslips,

ATO Notice of Assessments or tax returns, and bank statements.

- Stress testing: Lenders average your income over the past two years (often using the lower-earning year) and apply a buffer rate, usually around 3% above your loan rate, to ensure repayments stay under roughly 30–35% of your gross income.

Most casual or part-time borrowers use a low-documentation (low-doc) home loan. These loans are designed for irregular incomes but come with:

- Longer income-history requirement: Typically 12 months of continuous earnings in the same field.

- Tighter LVR caps: You often need a minimum 20% deposit.

- Higher rates and fees: To offset perceived risk.

Some traditional loans will accept casual or part-time income after six months in your role, but they’ll scrutinise your hours and pay patterns more closely. A mortgage broker can match you with lenders whose policies favour non-standard incomes.

What are the home loan options available for part-time workers?

Navigating the home-loan landscape as a part-time earner can feel like juggling half a dozen complex products at once. A specialist mortgage broker can cut through the clutter, matching your casual income profile to lenders with flexible criteria and negotiating sharper rates on your behalf.

Here are the top loan options commonly available to part-time workers:

Standard Variable-Rate Home Loans

Any borrower with 6–12 months of PAYG evidence, including part-timers, can apply, provided you meet the lender’s serviceability and buffer tests. You’ll get flexible repayments, discretionary extra-repayment and redraw features, but your rate will move with the market.

Fixed-Rate Home Loans

Locks your interest rate for 1–5 years, giving you predictable repayments even if your take-home pay swings. Although you miss out on rate drops during the fixed period, budgeting becomes simpler when your income isn’t 9-to-5.

Low-Documentation (Low-Doc) Loans

Aimed at borrowers who can’t produce full payslips or ATO assessments, but part-timers with 12 months of consistent bank-audited deposits may qualify. You’ll typically need a 20%+ deposit and pay slightly higher rates to offset lender risk.

Low-Deposit Loans

Let you borrow with just a 5–10% deposit, either via LMI or through government guarantees, though you’ll face stricter serviceability checks. Expect Lenders’ Mortgage Insurance premiums if your deposit is below 20%, or income and price caps if you use a First Home Guarantee.

Guarantor (Family Pledge) Loans

A close family member pledges equity in their property to cover part of your deposit shortfall, helping you avoid or reduce LMI. You still undergo the same stress tests on your part-time wages, but can borrow up to 95–100% of the property value.

Government-Backed Home Guarantee Schemes

Programs like the

First Home Guarantee allow eligible part-time earners to secure a loan with just a 5% deposit and no LMI, subject to

NHFIC’s price and income caps. You must apply via a Participating Lender and pass the usual lender serviceability rules.

Each of these loans carry different deposit, documentation and cost implications. A broker’s expertise can be invaluable in pinpointing the right lender and loan structure for your part-time income.

Your Part-Time Income, Our Full-Time Support:

Let our Sydney mortgage brokers match you with lenders that value casual and fixed-term incomes. Get personalised rate comparisons and application support. Call

0403 316 686 or go to

www.mortgagebrokersnorthernbeaches.com.au now!

How to apply for a home loan as a part-time worker?

Here’s how to turn your part-time earnings into a home-loan approval:

1. Assess your financial snapshot

Check your credit report, outstanding debts and monthly outgoings to ensure you meet serviceability requirements. Knowing exactly what you can afford prevents surprises when lenders run their stress tests.

Top tip: Aim to have your debt-to-income ratio under 30% to demonstrate you’re a low-risk borrower.

2. Gather your income documentation

Compile at least 6–12 months of payslips, bank statements showing regular deposits and your latest ATO Notice of Assessment. Even casual timesheets or a letter from your employer can bolster an irregular-income case.

Top tip: If you’ve switched roles or employers, include a written reference confirming hours and pay consistency.

3. Save and plan for your deposit

Aim for a minimum 5–10% of the purchase price—or 20% if you want to avoid LMI altogether. Factor in upfront costs like stamp duty, legal fees and lender fees so you’re not caught short.

Top tip: Set up an automatic transfer of a fixed amount each payday into a dedicated savings account.

4. Seek pre-approval

Submit your basic details and documentation to a lender (or via your broker) to lock in an indicative borrowing limit. Pre-approval shows sellers you’re serious and flags any income-proof gaps early.

Top tip: Get pre-approval from two different lenders for comparison, but do it within a 30-day window to minimise credit-score impact.

5. Compare lenders (or engage a broker)

Review interest rates, fees, repayment features and eligibility criteria side by side. A broker specialising in non-standard incomes can shortlist lenders whose policies favour part-timers, saving you hours of research.

Top tip: Ask about rate discounts, fee waivers or cashback offers, especially those negotiated by brokers with preferred relationships.

6. Submit your formal application

Provide your chosen lender with complete forms, certified IDs and any extra evidence they request (e.g., employment contracts). Respond promptly to any follow-up questions to keep your file moving.

Top tip: Keep a checklist of submitted items and follow up weekly with your broker or lender to avoid delays.

Following these steps, and leaning on a specialist broker where it counts, will streamline your journey from part-time pay to home-loan approval.

From Casual Pay to Contract of Sale:

Partner with seasoned Sydney mortgage brokers who negotiate on your behalf, secure pre-approval and simplify documentation for part-time workers. Call us at

0403 316 686 or visit

www.mortgagebrokersnorthernbeaches.com.au today to schedule a free consultation with our brokers.

Frequently Asked Questions (FAQs)

Can you get a loan on a part-time job?

Yes. If you can show consistent income and submit the right documents like PAYG summaries and employment contracts, many lenders will consider your loan application.

Can I buy a house without a full-time job?

Yes. As long as you can show proof of income and income stability, part-time workers or casual employees can still apply. A full-time job isn’t the only path to homeownership.

What is the minimum work experience for a home loan?

Most lenders prefer you to have worked in your current position for at least 6 to 12 months. A history of part-time employment with regular hours or consistent income can also work in your favour.

Can a part-time employee qualify for a home loan with a small deposit?

Yes. Even without a large deposit, lenders may approve you if you agree to pay Lenders Mortgage Insurance and demonstrate strong borrowing power.

Do lenders treat casual employment differently than part-time roles?

Yes. While part-time workers may show more regular hours and a fixed income level, casual roles often mean income variability. Lenders may ask for more documentation and a longer employment history.

Can I use other sources of income for a loan application?

Yes. Some lenders will count rental income, additional income from side work, or support payments toward your borrowing capacity if you provide proper records.

Are there low-doc options for casual or self-employed workers?

Yes. Low-doc loans can help if you lack full tax returns or complete financial records. These loans let you show alternative proof of employment and income.

Final Thoughts

With the right guidance, part-time earners can absolutely tap into home loans for part-time workers that suit their income and lifestyle.

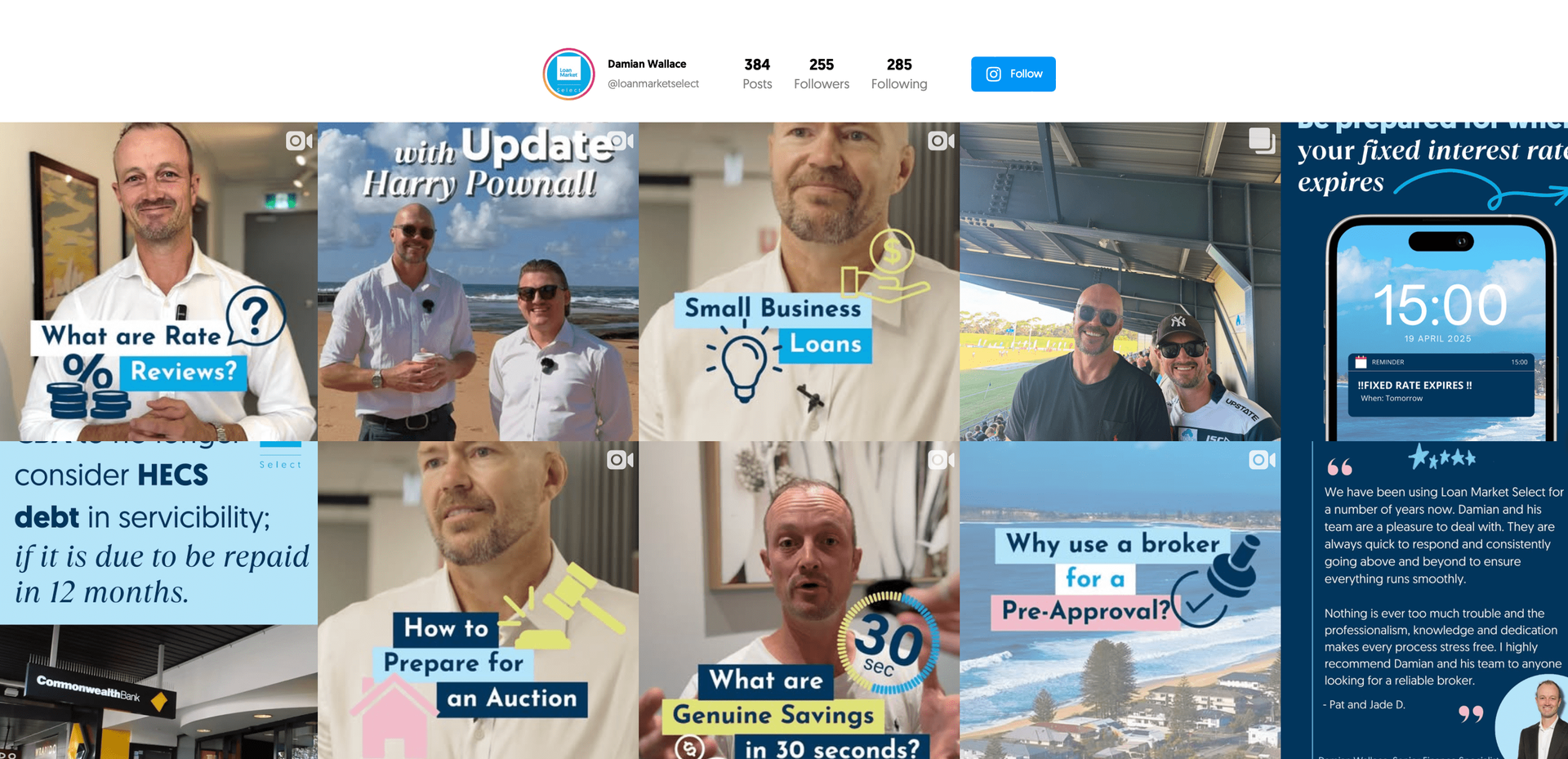

As mortgage brokers based in North Sydney and covering wider Sydney, including the Northern Beaches, we specialise in helping part-time homebuyers present their casual or fixed-term income in the best light. We’ll sort the paperwork, compare deals, negotiate rates, and liaise with lenders so you don’t have to.

Ready to turn your part-time pay into a place you can call home? Get in touch for a free consultation on 0403 316 686 or visit www.mortgagebrokersnorthernbeaches.com.au today!

Chat to our team about your home loan needs.

Our services are 100% free, so please don't hesitate to get in touch.

Contact Us

Phone:

📞 0403 316 686

Email:

damian.wallace@loanmarket.com.au

Office Address: 1303/213 Miller St,

North Sydney, NSW, 2060